Table of Contents

- 2024 Vs 2026 Tax Brackets - Aimee Atlante

- Planning for Personal Tax Laws Changing in 2026 | Mercer Advisors

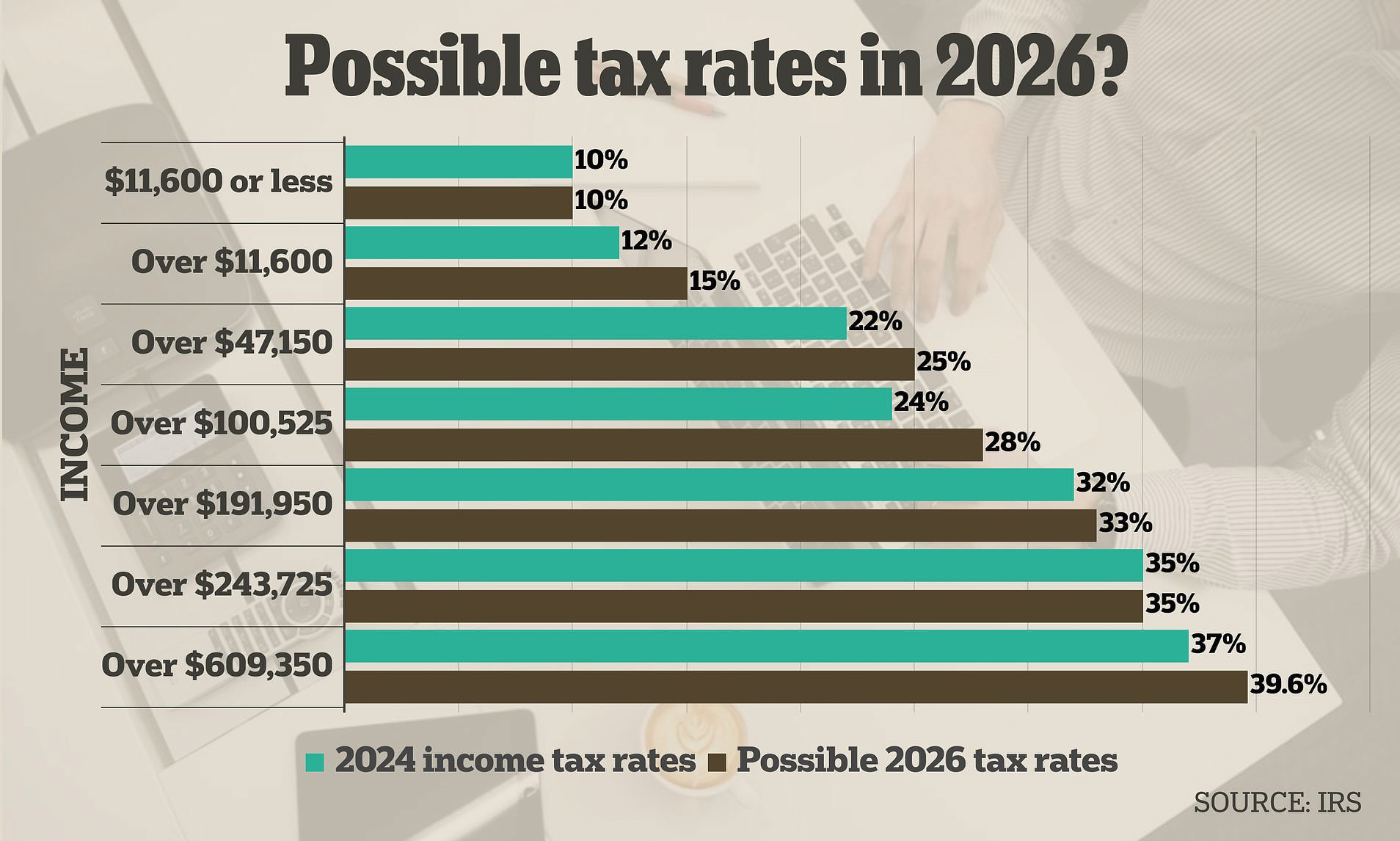

- The reason why you may have to pay MORE tax in 2026

- TCJA Expiring: Taxes Are Set to Increase in 2026

- Plan now? The estate planning 2026 question mark | MassMutual

- 2024 Irs Tax Rate Schedule - Kira Serena

- T22-0091 - Share of Federal Taxes - All Tax Units, By Expanded Cash ...

- 2026 Income Tax Increase - YouTube

- Tax Brackets For 2024 Head Of Household And Single - Teena Genvieve

- Tax Brackets For 2024 Head Of Household And Single - Teena Genvieve

Understanding Oregon State Income Tax

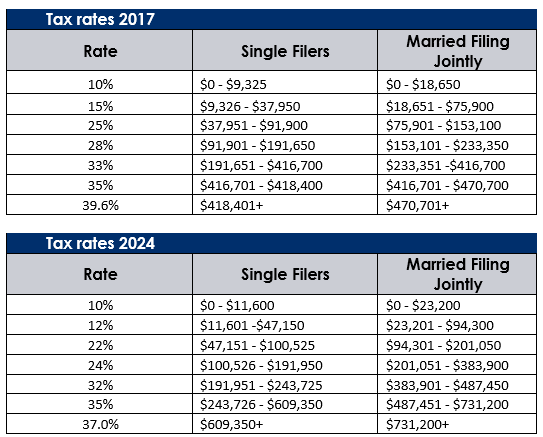

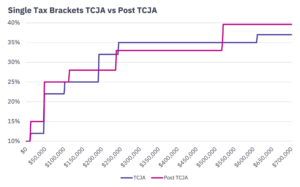

Tax Rates and Brackets

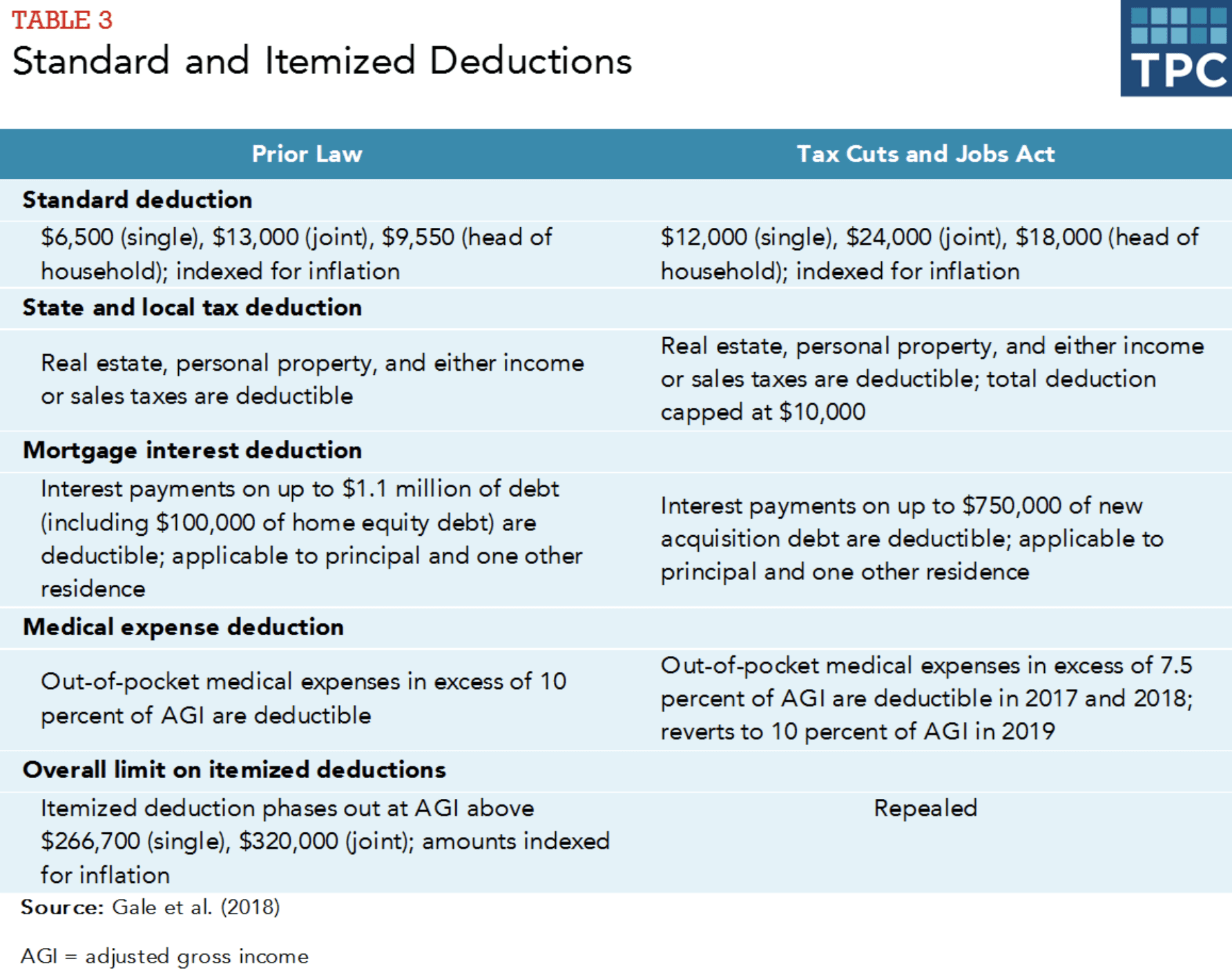

Deductions and Credits

Oregon offers various deductions and credits to reduce taxable income. Some of the most common deductions include: Standard deduction: $2,270 for single filers and $4,540 for joint filers Itemized deductions: medical expenses, mortgage interest, and charitable donations Retirement savings contributions: deductions for contributions to 401(k) and IRA accounts Oregon also offers various tax credits, including: Earned Income Tax Credit (EITC): a refundable credit for low-income working individuals and families Child Tax Credit: a non-refundable credit for families with dependent children